Our financial services social media strategy recommendations and best-practice case studies put you in the driving seat to accelerate your financial services' ROI from digital marketing

Over the past few years, financial service organizations have embraced social selling programs and employee advocacy. Those integrating the data they have generated by their financial services social media strategies into a single source of customer truth are flourishing.

Social media is sometimes perceived as less relevant in financial services compared to other channels such as search, display, and aggregators. There are well-rehearsed objections to investing more in social media in financial services. However, we will see by the examples in this section that creative options are possible within the constraints of compliance.

Financial organizations are effectively engaging with digital customers, differentiating with real-time communication via social channels. There has been a clear shift from pre-review to post-review with the industry treating social media posts as interactive communication rather than static advertising.

Companies are recognizing that social media provides a wealth of value, enabling differentiation through human communication. They are driving value by integrating this with their CRM systems, tracking ROI, and ensuring compliance. To drive such value, organizations expect solutions to help them track ROI, integrate with CRM solutions, provide compliance, and offer best-in-class publishing tools. To address this, we have covered a number of trends and innovations in the financial services industry which, alongside social media trends featured in this blog, help marketers and managers an integrated marketing strategy for their financial services businesses.

Owing to the financial sector having access to detailed customer data, we are seeing an increase in social advertising by the financial services sector, with Lookalike Audience modeling in Facebook ads increasing in popularity. This means segmenting the audience into groups of people who ‘look like’ their current customers and website visitors. Mobile video ads on YouTube and retargeting LinkedIn prospects on Instagram in order to reach the same audience at a lower cost are also good ways of connecting with potential customers.

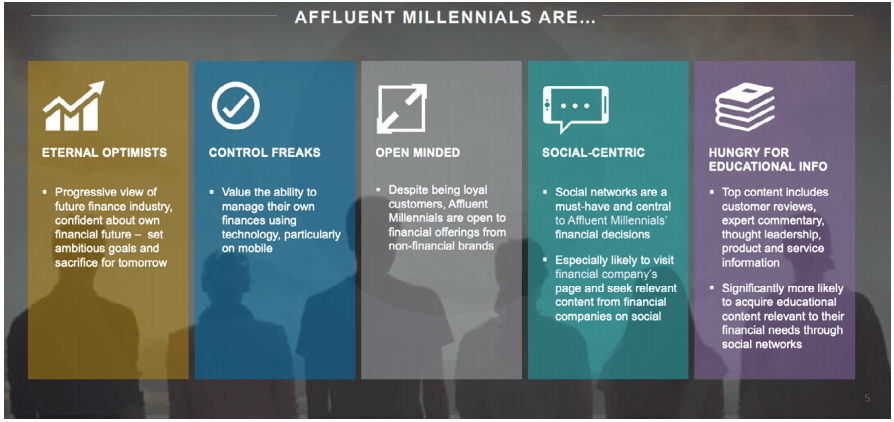

Financial services social media for the affluent millennial audience

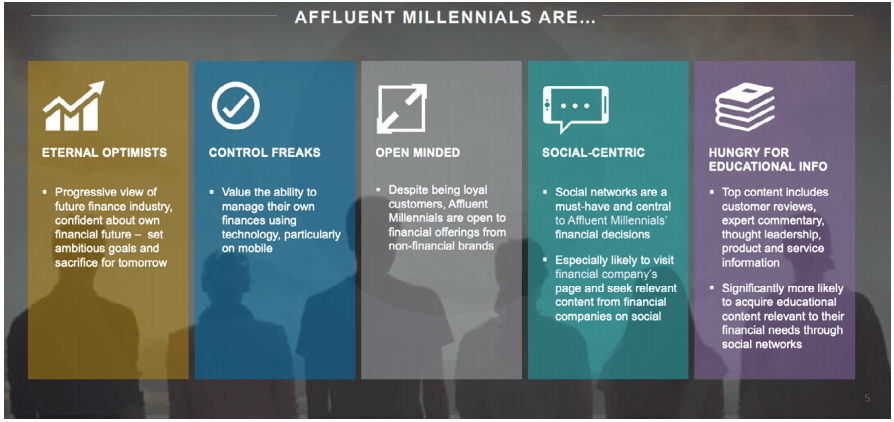

The rise and rise of affluent millennials has led to a trend of lower-funnel-focused programs where FS companies deploying a wide range of successful marketing tactics, as part of a full-funnel strategy to acquire new clients create a specialized program for investments that specifically targets the highest-value and most profitable customers.

Reflecting on their choice to use LinkedIn to achieve this one company Digital Advertising Manager said “LinkedIn provides us with the opportunity to target these potential prospects with self-identifying information through profile targeting, we can target these prospects based on post-secondary affiliations, their job functions, and also their job titles.”

This audience is seeking advice and will more often look to LinkedIn to determine the credibility of the advice than other social platforms. Joe Pope from Hinge Marketing suggests that the number one criteria when a buyer is evaluating a professional service provider is understanding expertise through past performance (>35%). For a firm, this experience can take the form of project examples, client testimonials, references, and case studies, to name a few. Among a variety of features, LinkedIn provides a forum for all of these elements on a standard profile page that can allow your company to become known as a visible expert or thought leader, and increase web traffic and conversions.

Financial services marketing strategy

Below, we've put together our social media strategy recommendations for financial services marketers based on the current trends and innovations in the sector. Social media is a huge part of your business's online presence, that's why we've broken it down, channel by channel.

Moreover, Smart Insights offers financial services marketing strategy across all aspects of the marketing mix, plus strategy and planning for marketing leaders. You can download our free financial services marketing trends 2021 report to discover 8 further industry trends which we recommend considering as part of your integrated marketing strategy. Find out more.

Financial Services marketing trends 2021

Accelerate your growth in 2021 with trends, examples, and practical strategy integrated with our RACE Framework

Get Started Today

Instagram

Instagram provides strong organic engagement, particularly with millennial clients and for attracting new workforce talent. FS brands are falling behind and haven’t broadly adopted the visual platform. Instagram’s advertising options are easy to manage (alongside Facebook advertising campaigns), as mobile video engagement continues to rise, as well as extended advertising options, such as ads in Stories.

SoFi uses Instagram

Online lender, SoFi has successfully used mobile advertising campaigns on Instagram and Facebook to achieve a 39% increase in loan applications. The company’s Instagram posts demonstrate its approach to resonating with the customer.

A cautionary tale - Influencer marketing on Instagram

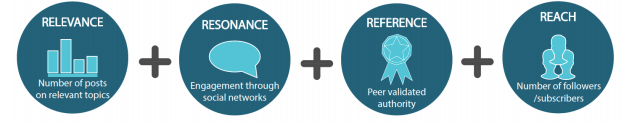

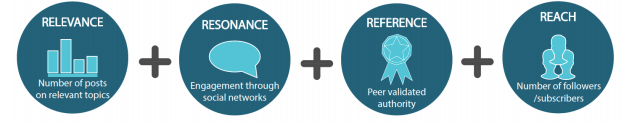

There is a wide variety of different influencers that you could engage with, so focus your engagement on certain types of people that you feel will best communicate your message to your target audience. According to Onalytica, there are four key measures of influence that you should analyze to find the key influencers in your market.

While these elements are important you need to consider the message they will be sending in the wider context of your audience.

An example of where this balance was deemed to be “not in the best interests of the public” was an Instagram influencer campaign conducted by Klarna, the Swedish firm which allows staggered payments for products with no fees or interest and has proved popular among millennials.

The UK’s advertising watchdog has banned an Instagram influencer campaign for “irresponsibly” encouraging customers to use the “buy now, pay later” service to cheer themselves up during the pandemic.

The company ran a social media campaign on Facebook-owned Instagram in April and May of 2020 using four influencers to encourage people to use Klarna to shop to “boost their mood”.

The influencers posted about clothes, expensive skincare products and other non-essential items during the campaign period while praising Klarna.

While it was acknowledged that “treating oneself can elevate mood” the regulator felt that the promotion of deferred payments was not compatible with the intended message. As a result of this campaign and similar ones, the Financial Conduct Authority is looking at operators in the “buy now, pay later” sector as part of a wider inquiry into the unsecured credit market.

LinkedIn

LinkedIn remains the central social channel for financial services organizations, now reaching 590+ million professionals. 98% of the Forbes Fortune 500 list are using LinkedIn, with content amplification and connecting with prospective clients continuing to be the top reasons for use. FinTech companies, who have typically invested in Facebook as their primary channel, are investing more in LinkedIn with FS organizations increasingly using their CEO or senior leadership figures to amplify their content through personal insights and thought leadership articles.

Facebook

Owing to financial services organizations being rich in customer data, we are seeing an increase in the uptake of custom and lookalike audience modeling on Facebook. Mobile video is popular, including brand discovery via the Explore tab and the use of Facebook Groups, with encouragement from the use of AI. Messenger can also be used for one-to-one communication and branded Facebook Groups relating to personal finance and career topics.

YouTube

This channel is commonly used amongst financial services organizations for extending the reach of TV advertising campaigns, building playlists with content relating to personal finance and investing topics, plus targeting high-value prospects with pre-roll advertising. YouTube has seen increased adoption by the Fortune 500 with 75% of companies holding active accounts – a 67% year-on-year increase. According to ComScore, there has been a 26% year-on-year increase of YouTube mobile viewers aged 55-64 in 2018, with the channel reaching 95% of monthly online adults aged 55+.

Snapchat

Very few financial service organizations have mastered Snapchat. Its geotargeting tools, self-serve advertising tools, and location-based features could be used by the industry as a way of driving leads locally, for example, by local mortgage brokers to drive consultations with first-time home buyers. This, as well as searchable Stories, location-based Context Cards, and Snap Maps, could benefit the industry.

Twitter

Twitter is commonly used by financial services organizations for amplifying content, monitoring brand mentions and customer complaints, and locating buyer-buyer-ready signals. All of the Fortune 500 insurance companies, commercial banks, and financial data service companies have a presence on Twitter.

Financial services social media videos

From the launch of Facebook’s Watch tab to the high performance of mobile video advertisements on YouTube, social video is dominating content formats in the financial sector. According to Unmetric, video content accounts for 16% of all social media content published by banks. The likes of TD Bank US, BMO Harris Bank, and Capital One are generating a significant number of social interactions through their use of video content. According to Hootsuite, video content is twice as likely to be shared by users than other types of content.

Find out more about marketing trends for financial services leaders in 2021 by downloading your free copy of our report, packed with best-practice advice and examples. Get started today.

Financial Services marketing trends 2021

Accelerate your growth in 2021 with trends, examples, and practical strategy integrated with our RACE Framework

Get Started Today

Consumer privacy laws: GDPR and ePrivacy

You will be aware that the General Data Protection Regulation (GDPR) (Regulation (EU) 2016/679) came into force in all 28 countries in Europe in 2018. It is a regulation agreed by the European Union, which seeks to improve transparency and the effectiveness of data protection activities. The legislation highlights the importance of obtaining consent from new and existing customers, who subscribe to mailing lists and have their data stored in CRM and other systems.

But do you know the changes required by the EU ePrivacy law? In the UK, this will be covered by changes to the Privacy and Electronic Communications Regulations (PECR), originally enacted in 2003. We're 'flagging this up' since this is due to be updated in 2021 with the UK having left the EU, but the situation and regulations are still relatively unclear as of the time of writing. One thing is for sure, it's likely to have implications on your use of cookies, site personalization, and email marketing communications. To learn more about how Brexit affects your marketing and use of personal data, the UK Government website's guidance pages are a good start.

In a move that supposedly promotes privacy, Apple's iOS 14 update arrived in late 2020 with some serious knock-on effects for advertisers and app publishers. Apple effectively limited data collection and sharing by default for all devices running version 14 of their operating system - blocking or severely reducing performance reporting and ad personalization, for example.

Keep your financial services social media strategy consistent

Social media campaigns are most effective when each platform is working together consistently under a common theme, with the unique messaging and content types customized for each channel. Appreciating the strengths of each major social media platform assists financial marketers in establishing a focused and manageable social media strategy. A good example is TSB who has used social channels with a consistent tone of voice and frequent messaging promoting its brand position.

Our financial services trends report covers a great number of trends and innovations in the sector so you can implement an effective, integrated marketing strategy.

Financial Services marketing trends 2021

Accelerate your growth in 2021 with trends, examples, and practical strategy integrated with our RACE Framework

Get Started Today